What If A Market Roared And Nobody Heard It?

We all know about new highs in the Dow Jones Industrials, the NASDAQ, and the S&P 500. The market has been driven higher by a mere handful of very large tech companies. Some of the indices are already up 8% or so, just in the first two months of the year. The equally weighted S&P is up slightly more than half that amount.

At least for ourselves, we continue to stay with the trend with reduced allocation to stocks because, while the market is expensive and distorted, it has not violated any meaningful linear or moving average trend. Although the market action has been distorted, it is still undeniably positive.

Yes, we remain concerned about extreme levels of sentiment and valuation, and that is why we reduced risk.

Fed Chairman Jerome Powell again reassured the market that interest rate cuts are forthcoming, as soon as inflation cools a bit more. However, services inflation is not cooperating and now fuel prices are rising as well. The FED remains in a tough spot to deliver all the markets expect.

As Martin Zweig advised, don’t fight the trend, and don’t fight the FED.

The reasons for the advance in equities now seem pretty obvious. The FED stated earlier that it would be cutting interest rates. Markets began the year wildly optimistic, projecting up to seven rate cuts. Those expectations have been scaled back but rate cuts are expected by summer as the FED normally will not cut within about 6 months of a Presidential election. And, the economy has made a rebound after the disastrous lockdown policies and continues to outshine Europe, Canada, and China. It has defied expectations of recession.

In addition, the hype about Artificial Intelligence keeps driving the tech companies upward. Even though Google had some extreme embarrassment with Gemini, investors rightly or wrongly, are putting great faith in the earnings potential of AI.

We are skeptical. Let’s hope the nexus between artificial intelligence and natural stupidity will eventually produce a better product than Gemini. It appears to have been programmed by the Communist Party, which would appeal to a rather small market.

Markets have also been supported by enormous fiscal stimulus. Fully one-third of GDP “growth” is the growth of government.

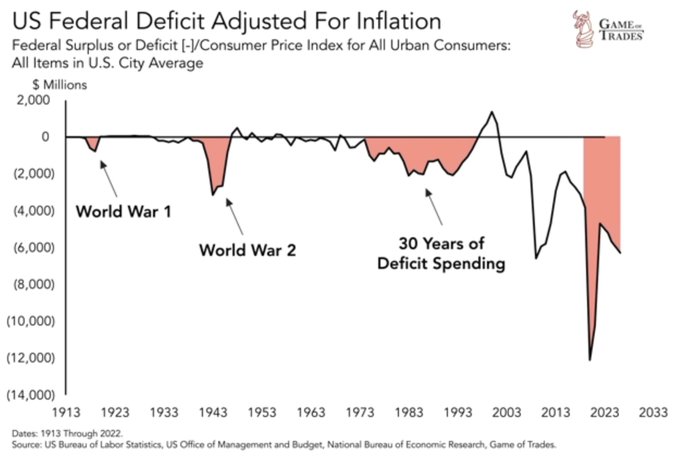

This fiscal stimulus rivals or exceeds previous periods. The website Game of Trades put together this interesting inflation-adjusted chart.

The current budget deficit, in inflation-adjusted dollars, exceeds all the deficits needed to finance WWI, WWII, and 30 years of deficit spending, COMBINED.

The size of this deficit spending may explain why one other market has gone to new highs, yet has gotten very little attention.

We are talking about the gold market. Gold gets little attention compared to the soaring market and all the hype about AI.

But we know it is of interest to Conservatives if for no other reason, it seems most of the Conservative talk radio shows and podcasts have a gold advertiser. The Prickly Pear is no exception with our loyal advertiser, American Precious Metals. We hope you will call them at 602-840-5500 or 1-800-522-GOLD when you desire to buy or sell physical metals. If you want to help independent citizen journalism, please support our sponsors.

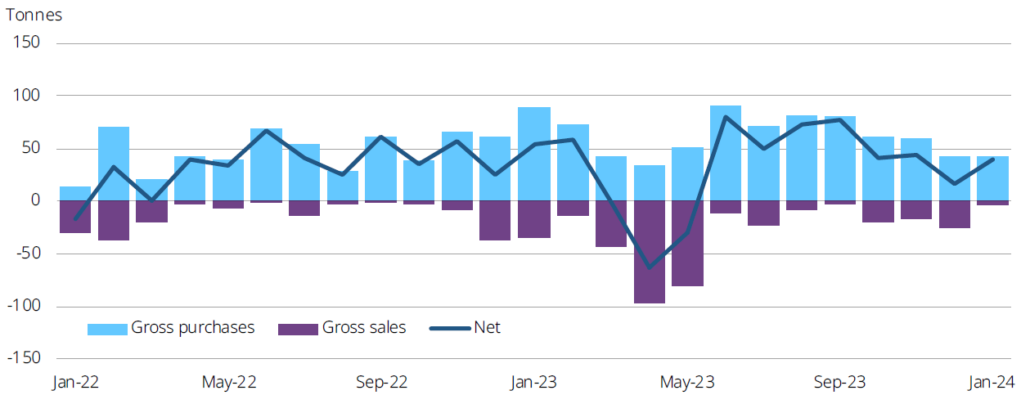

Further, most Conservatives look with great anxiety at the wild government spending and soaring debt at all levels of society. Gold is portfolio insurance even if presently it is not a hot investment.

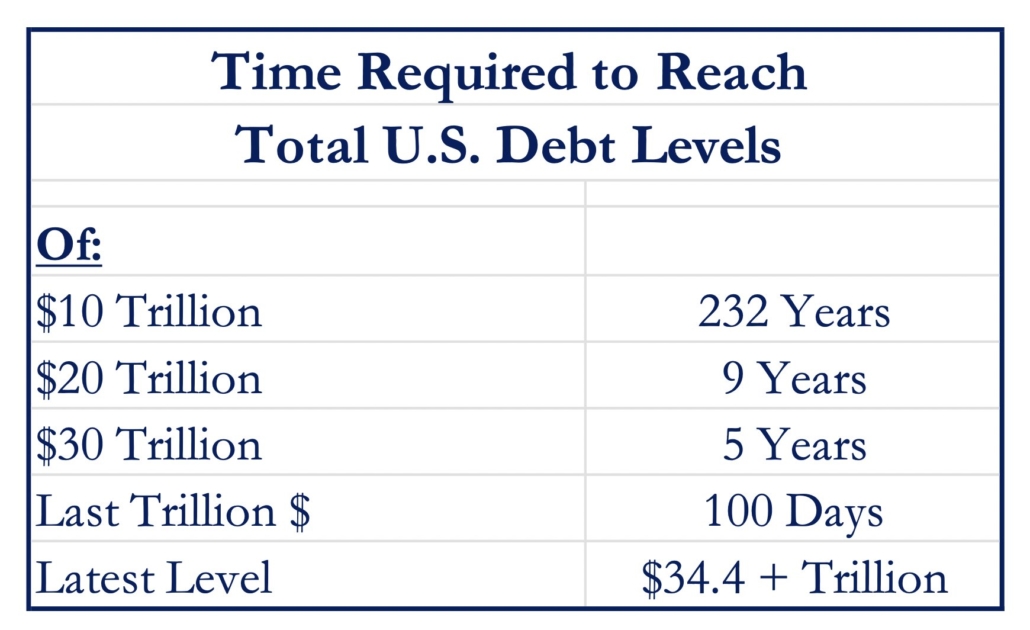

Federal debt is now rising at a breath-taking clip of about a Trillion dollars every four months. One wonders how long this can continue before something breaks. Between the rollover of existing debt and the funding of new debt, the bond market must swallow over $10 trillion in issuance in 2024. With most of the traditional foreign buyers reducing US Treasury holdings, financing this debt with falling rates appears contradictory. Interest costs on the debt now exceed $1 Trillion and likely will move even higher as low-interest rate bonds mature and must be refinanced.

If you look at the weekly chart for gold, you can see that from the fall of 2018 to the summer of 2020, it rose about 70%. Since then, we have been a broad congestion, for almost four years, but recently gold broke a triple top, a bullish thing to happen from such a large consolidation. That certainly is a positive development.

Some of the traditional stimulants for gold appear missing. The dollar has not been particularly feeble, and usually, they move opposite each other. The same can be said for equities. Gold usually moves opposite the direction of stocks and that is why it has historically been a good portfolio diversifier.

Gold usually does well when “systemic risk” to financial stability is high. While the potential of excessive debt certainly remains present, neither stock nor bond markets are acting concerned. Bank troubles are to be “believed” contained although Powell suggested in his recent speech before Congress to expect more bank failures.

Maybe equity markets should be more concerned, but stocks as noted before, are pushing higher along a broad front.

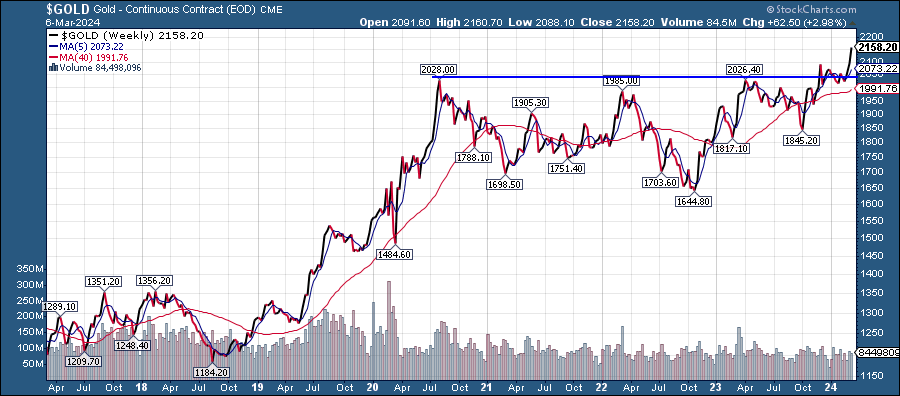

Despite the wild spending and record debt build-up, public enthusiasm for gold remains subdued, if not negative. Western investors continue to liquidate ounces from the gold bullion ETFs and physical dealers we know say demand is weak with about as many liquidations as purchases. The chart below from the World Gold Council shows the oddity of the public leaving gold ETFs while bullion is firming. Only in Asia is the flow positive into their respective ETFs and that has been the case for 12 months.

We do know that central bank demand continues to be robust, but that still can’t quite explain gold’s strength with such flaccid demand from investors.

One explanation is that the center of the gold market, which used to be London and New York, which is mostly a commodity futures market, has moved Eastward to China and there it is mostly a physical market. Prices for both gold and silver are at a premium in Shanghai right now, indicating strong demand. But why don’t investors buy in the cheaper Western markets and close the gap in prices through arbitrage? Likely because buyers don’t want futures (paper gold) but want the real stuff in hand.

Why do Asians want the real stuff and Americans don’t? Perhaps because they have seen the collapse of huge real estate developments like Evergrande where a whopping 70% of Chinese household wealth is now stuck in these failing real estate institutions. They want to hold something that won’t go broke.

BRICS now represents about 50% of the global population and more than a third of global oil production.

The largest Arab state, Egypt just devalued its currency by 30%, hurt badly by a collapse in revenue from Suez Canal traffic, largely caused by Iran’s proxy the Houthis.

War in the Ukraine and Gaza continues.

Interestingly, gold has been below $2,000 per ounce for only two days this year, both days the Chinese markets were closed for their New Year.

Speaking of going broke, the reason central banks have been buying at the fastest pace in 50 years is outside of the US, investors are more worried about the rapid explosion of US debt, and prospects for more to come. We agree and think the US public should be a lot more concerned than it currently is.

The Kobeissi Letter recently summarized current contradictions in the markets rather succinctly:

“1. The S&P 500 is trading like we are in a new bull market.

2. Regional bank stocks are crashing like the crisis never ended.

3. Bonds are rising like the Fed is cutting interest rates.

4. Inflation data is rising like rate cuts are canceled.

5. Bitcoin is rising like there’s no recession coming.

6. Gold is rising like a recession is on the way.

Nothing adds up here.”

We agree it is confusing but we think new highs in gold are telling us something. If we had to guess it is a combination of strong Chinese demand and central bank demand. That central bank demand stems from the recognition that the US has entered a “doom loop”, that is, we are now borrowing money to pay interest on the debt.

What is the potential for gold? Given that few investors are in, it would appear substantial. Imagine if Western investors quit selling and joined the East and Central Banks in buying.

The same can be said for gold mining equities, which have been shunned for about a decade. Only one other time in 2015 were gold mining shares this cheap relative to bullion.

At any rate, gold is at new highs and it seems few care. Since gold tends to do best when there is systemic financial risk, its rise should not be ignored.

*****

Charts courtesy of Stockcharts.com and The World Gold Council, Game of Trades, and Holger Zschaepitz