It Gets Ugly: Dollar’s Purchasing Power Plunged at Fastest Pace since 1982. It’s “Permanent” not “Temporary,” Won’t Bounce Back

The Consumer Price Index jumped 0.6% in May, after having jumped 0.8% in April, and 0.6% in March – all three the steepest month-to-month jumps since 2009, according to the Bureau of Labor Statistics today. For the three months combined, CPI has jumped by 2.0%, or by an “annualized” pace of 8.1%. This current three-month pace of inflation as measured by CPI has nothing to do with the now infamous “Base Effect,” which I discussed in early April in preparation for these crazy times; the Base Effect applies only to year-over-year comparisons.

On a year-over-year basis, including the Base Effect, but also including the low readings last fall which reduces the 12-month rate, CPI rose 5.0%, the largest year-over-year increase since 2008.

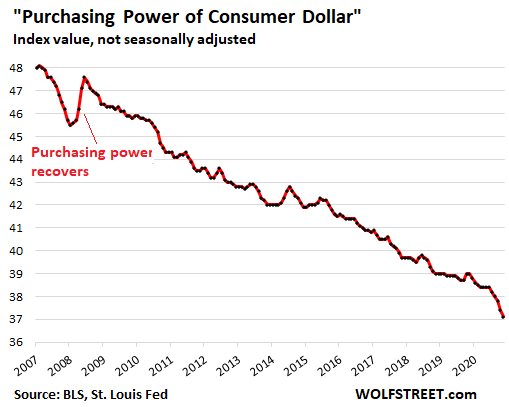

In terms of the politically incorrect way of calling consumer price inflation: The purchasing power of the consumer dollar – everything denominated in dollars for consumers, including their labor – has dropped by 0.8% in May, according to the BLS, and by 2.4% over the past three months, the biggest three-month plunge in purchasing power since 1982:

On an annualized basis, the three-month drop in purchasing power amounted to a drop of 9.5%, and this eliminates the Base Effect which only applies to year-over-year comparisons.

That plunge in purchasing power is “permanent” not “temporary.”

Yup, the current plunge in purchasing power is permanent. And the plunge in purchasing power in the future is also permanent.

The only thing that might make a small portion of it “temporary” is if there is a period of consumer price deflation, which has happened for only a few quarters in my entire life, for example in the last few months of 2008, which is indicated in the chart above. So I’m not getting my hopes up.

The rest of the time, we’ve had lots of decline in purchasing power. And that has proven to be rock-solid “permanent,” and we never got that lost purchasing power back.

******

Continue reading this article, published June 10, 2021 at Wolf Street.