The End of Easy Money: Bankruptcy Filings Pile Up at Fastest Rate since 2010

A cleansing process, long overdue, to whittle down the corporate debt overhang and clear out deadwood, at the expense of investors.

It’s turning into a banner year for corporate bankruptcy filings, after years of Easy Money that caused all kinds of excesses, fueled by yield-chasing investors, in an environment where the Fed had repressed yields with all its might. Those yield-chasing investors kept even the most over-indebted zombies supplied with ever-more fresh money. But that era has ended. Interest rates are much higher, and investors are getting a little more prudent, and Easy Money is gone.

At the peak of the Fed’s yield repression in mid-2021, “BB”-rated companies – so these companies are “junk” rated – could borrow at around 3% (my cheat sheet for corporate credit rating scales by rating agencies). Companies are junk-rated because they have too much debt and inadequate cash flow to service that debt. In other words, investors risked life and limb to earn 3%, and now these investors are asked to surrender life and limb, so to speak. But that’s how it goes with yield-chasing.

These “BB” junk bond yields have risen to nearly 7%. This means these companies that had trouble producing enough cash flow to service their 3% or 5% debt, have to refinance this debt when it comes due or add new debt, at 7%. That 7% may still be low, considering inflation running around near that neighborhood, but it puts a lot more strain on those companies.

So lots of overindebted junk-rated companies will restructure their debts in bankruptcy court at the expense of stockholders, bondholders, and holders of their leveraged loans. That’s how it’s supposed to work. That’s how the corporate-debt burden gets lifted off the economy. And it’s starting to work that way.

S&P Global has released its May bankruptcy statistics for companies that are publicly traded with at least $2 million in assets or liabilities listed in their bankruptcy filings, and private companies with publicly traded debt (such as bonds) with at least $10 million in assets or liabilities listed in their bankruptcy filings.

In May, 54 of these types of companies filed for bankruptcy, including notably, among the big ones:

- Envision Healthcare

- Vice Holdings and its affiliate Vice Media (a creditor group plans to acquire Vice Media out of bankruptcy)

- Kiddie-Fernwal

- Monitronics International

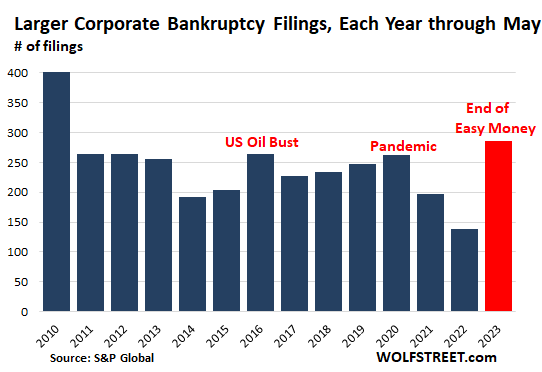

The May filings brought the five-month total to 286 bankruptcy filings, the most since 2010, more than double the filings for the same period in 2022 (138). And it even outran the 262 filings in the same period in 2020 when some companies faced enormous stress.

When the oil bust exacted its pound of flesh in 2016, and oil and gas drillers collapsed one after the other, S&P Global recorded 265 filings but concentrated in oil and gas. To get a higher number of filings than in the first five months of 2023, we have to go back to 2010, when 402 companies filed for bankruptcy during the first five months…..

*****

Continue reading this article at Wolf Street.